About the Research

The State of IT is an annual study that offers you a preview of organizations’ IT budget and tech adoption plans — brought to you by Spiceworks and Aberdeen Strategy & Research. Our relationships with millions of IT professionals and our proven analytical capabilities allow us to share insights that help everyone in IT stay ahead of the curve.

Key Highlights

The business world has experienced huge changes in recent years, thanks to a global pandemic, an accelerated shift to remote/hybrid work, economic uncertainty, disruptions to supply chains, rapid advancements in artificial intelligence, and more. Our latest research — fielded in late June and July 2023 — examines the impacts of these changes on organizations and the technologies they use, and offers advice for IT professionals and tech marketers on the road ahead.

84% of businesses are concerned about a potential recession. The vast majority of companies have recently cut costs as a precaution.

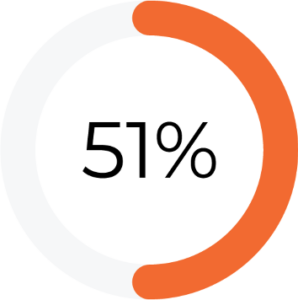

Economic worries won’t slow IT spending: 66% of respondents plan to increase their IT budgets in 2024. Only 4% have plans to decrease.

While IT hiring is expected to grow, 63% of senior tech leaders believe it’s currently difficult to hire skilled IT talent.

Plans to adopt emerging tech are moving forward. Within two years, organizations plan to double the use of edge computing, serverless computing, and AI.

Products / services cost increases

IT skills or labor shortages

Supply chain issues / logistical disruptions

On the bright side, fewer businesses expect supply chain issues to be a problem in 2024 compared to last year (42%). However, more companies are expecting to face challenges due to increases in costs and IT skills shortages in the coming year (46% and 28% in 2023, respectively).

Amid currently low unemployment rates and increased competition for job candidates due to skills shortages and remote work, many companies have had trouble finding qualified employees. That’s also the case in the IT labor market.

- 63% of senior tech leaders (director level and above) believe it’s currently difficult to hire skilled IT talent, compared to 58% last year

- IT hiring plans are up YoY: 41% of organizations plan to increase the size of internal IT staff vs. 31% last year

- 36% of IT professionals plan to look for a new job in 2024, similar to last year (34%)

- Only 14% of job seekers plan to apply exclusively to remote roles (down from 23% last year) as more companies push for a return to offices.

The State of IT Budgets

Despite recent cost cutting and ongoing challenges, there is reason to be optimistic. Most companies plan to raise IT budgets, and overall IT spending is expected to grow in 2024.

Two-thirds of businesses (66%) represented in our survey told us they plan to increase year-over-year IT spending while only 4% plan to decrease spending. The remaining 30% will keep their IT budgets level.

Enterprises (1000+ employees) are most likely to increase YoY spending, with 75% of these larger organizations expecting tech budgets to rise.

Overall, corporate IT spending is expected to grow by 6% YoY, with a median increase of 5% at a company level.

What’s driving more companies to increase their investments in IT, even as so many have cut overall costs to prepare for a potential recession? In our view, technology is essential in the modern workplace and a key driver of productivity. Cutting back doesn’t make sense from a business perspective, especially if technology spending has a positive impact on the bottom line.

“Aberdeen research has consistently shown significant benefits for businesses that modernize across IT, with a recent study finding that 45% of businesses that modernized and adopted new technologies reported improved ROI for their IT investments. This is also a driver in the rise in IT hiring, as businesses work to reduce challenges in lack of expertise and resources.”

Jim Rapoza – VP and Principal Analyst at Aberdeen Strategy & Research

Jim Rapoza – VP and Principal Analyst at Aberdeen Strategy & Research

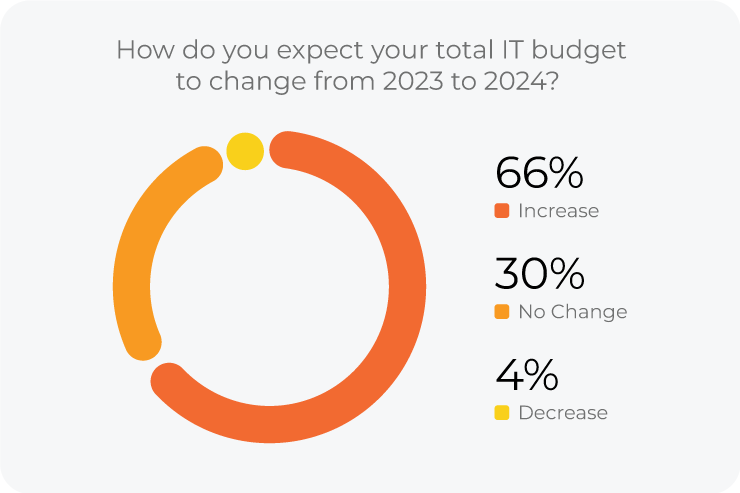

Factors influencing IT Budget Growth

Our ongoing State of IT research tracks many factors that are expected to influence budget growth. While spending increases in 2024 will be significantly influenced by rising costs, new funds more often will be used to directly address challenges and forge ahead with new initiatives.

The top reasons influencing spending planned growth in 2024 include: Need to update infrastructure, increased priority on IT projects, increased security concerns, inflation, and employee growth.

Notable Stats on IT Budget Drivers:

- Windows Server 2012 will reach end of support on October 12, 2023 — a previous Spiceworks study estimated that 24% of on-premises servers were running the popular operating system.

- 73% of companies expect their revenue to increase in 2024, and only 8% expect a decrease. Businesses are more optimistic compared to last year, when 58% of organizations expected revenue to rise.

- Companies are optimistic about hiring in 2024: 59% plan to increase the size of their overall staff, while only 8% plan to decrease.

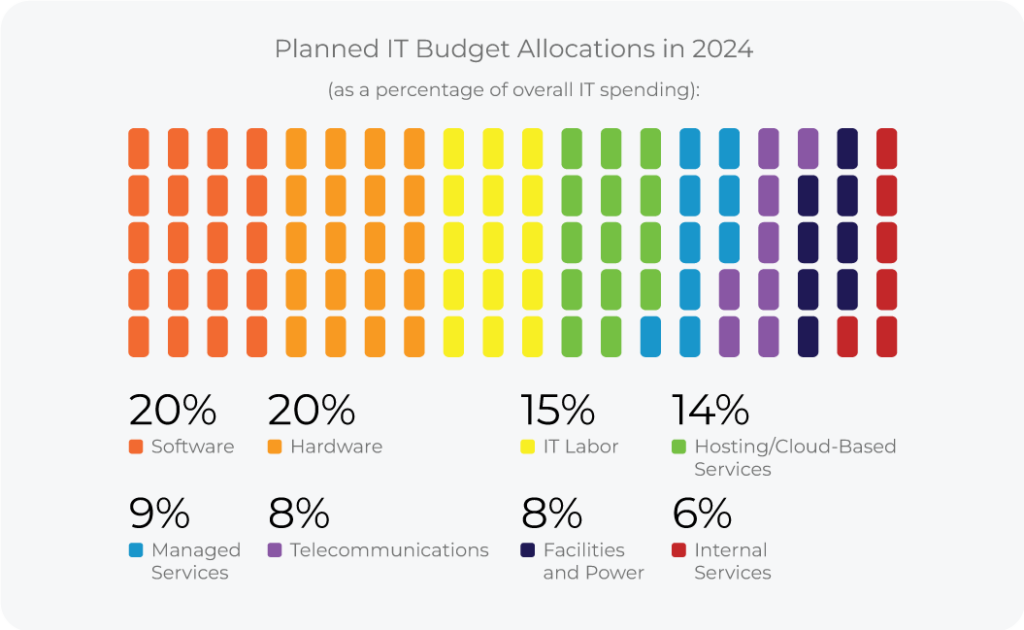

IT Budget Allocation: Detailed Spending Breakouts

In the 2024 edition of the State of IT report we updated our tech spending methodology to more accurately reflect how IT budgets are allocated in the real world. Going forward, we will use the more comprehensive Technology Business Management (TBM) framework, which in addition to previously tracked categories (such as hardware, software, cloud, and managed services) now includes additional categories such as IT labor, facilities, telecommunications, and internal services.

As a result, it will be more difficult to track YoY changes this year. However, our new framework comes with the benefit of more granular spending breakdowns, as shown below.

Notable Spending Trends:

- The smallest businesses (<100 employees) are expected to spend a significantly greater proportion of their IT budgets on hardware (24%) than mid-size companies (100-999 employees) at 19%, and enterprises (1000+ employees) at 16%.

- Compared to smaller companies, larger ones spend a greater proportion of their IT budgets on managed services, facilities and power, and internal services.

Top Spending Area by Category:

- Hardware: Laptops, desktops, servers, networking

- Software: Security, productivity, operating systems, databases, virtualization

- Cloud and hosted services: Online backup and restore, productivity, IaaS, web hosting, email hosting

- Managed services: Managed security, hosting, cloud infrastructure, backup and recovery

- Facilities: Power and climate, utilities, data centers, physical security

- Telecom: ISPs, mobile charges, telephone charges, WAN

- IT labor: Senior employees and mid-level employees

Want more 2024 IT budget data?

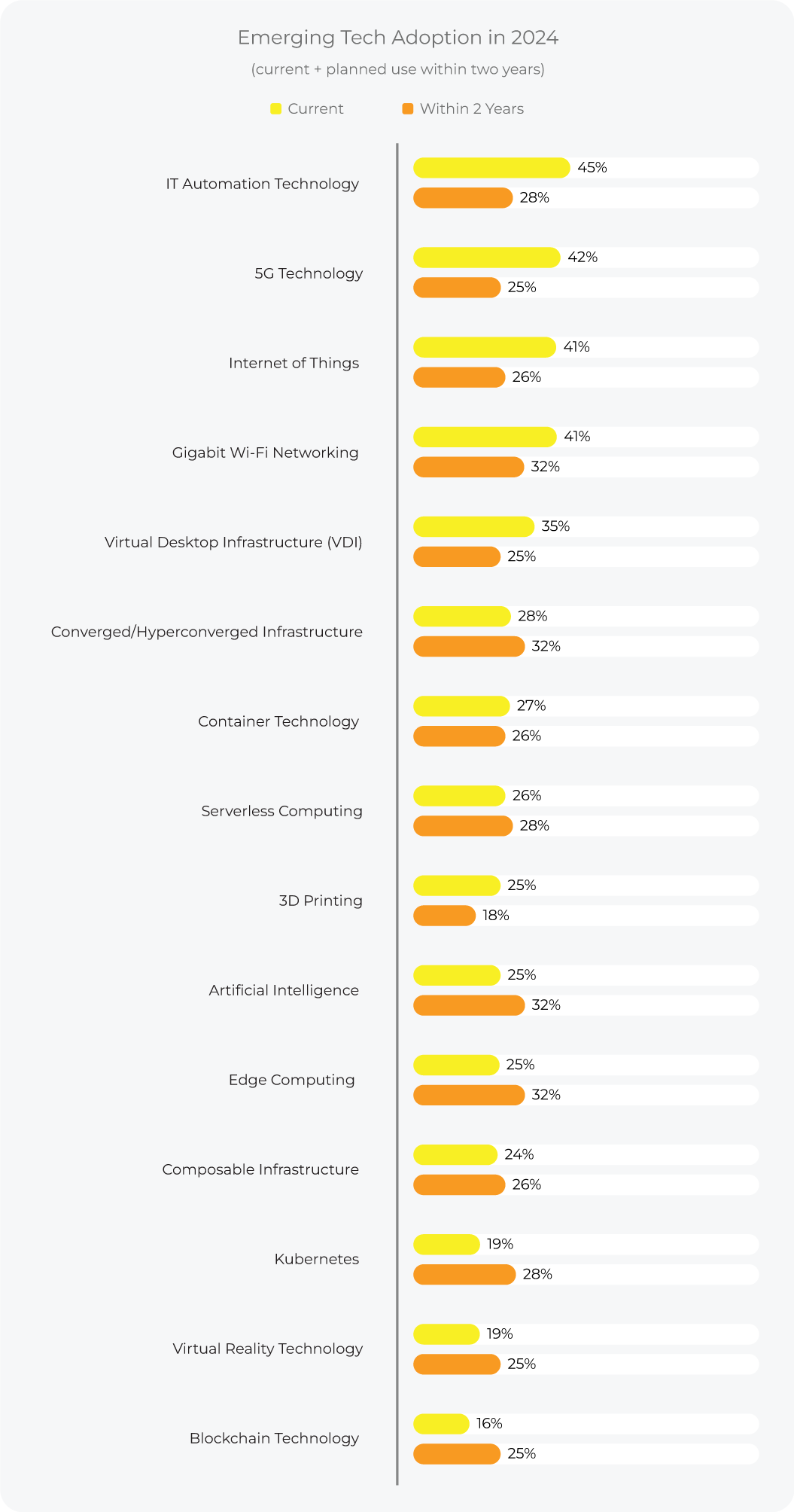

Emerging Tech Adoption

When budgets tighten, non-essential spending is typically cut first. For that reason, one gauge of optimism we watch is plans to invest in emerging technologies — ones that might not be essential to core business functions or have an immediate return on investment. Tracking these tech trends also helps us understand which specific solutions are being implemented within the broader technology spending categories.

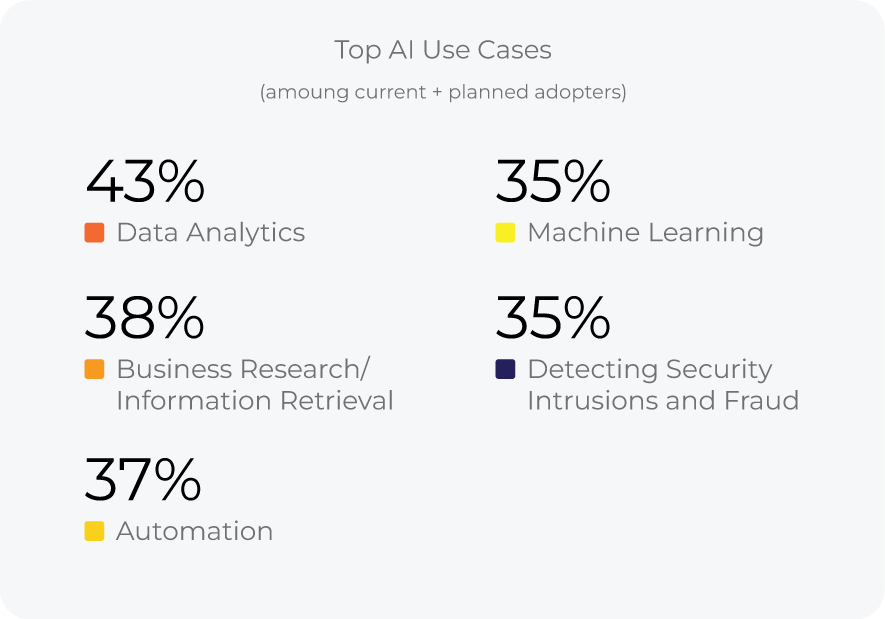

Looking forward, adoption plans are strong across all technologies we’re currently tracking. Notably, businesses anticipate that they will double the adoption of the following within the next two years: Kubernetes, edge computing, converged infrastructure, serverless computing, and artificial intelligence (AI).

Additionally, more than half (57%) of businesses plan to adopt AI within the next two years (25% currently, 32% within 2 years).

Coming soon: Stay tuned for the upcoming State of AI report

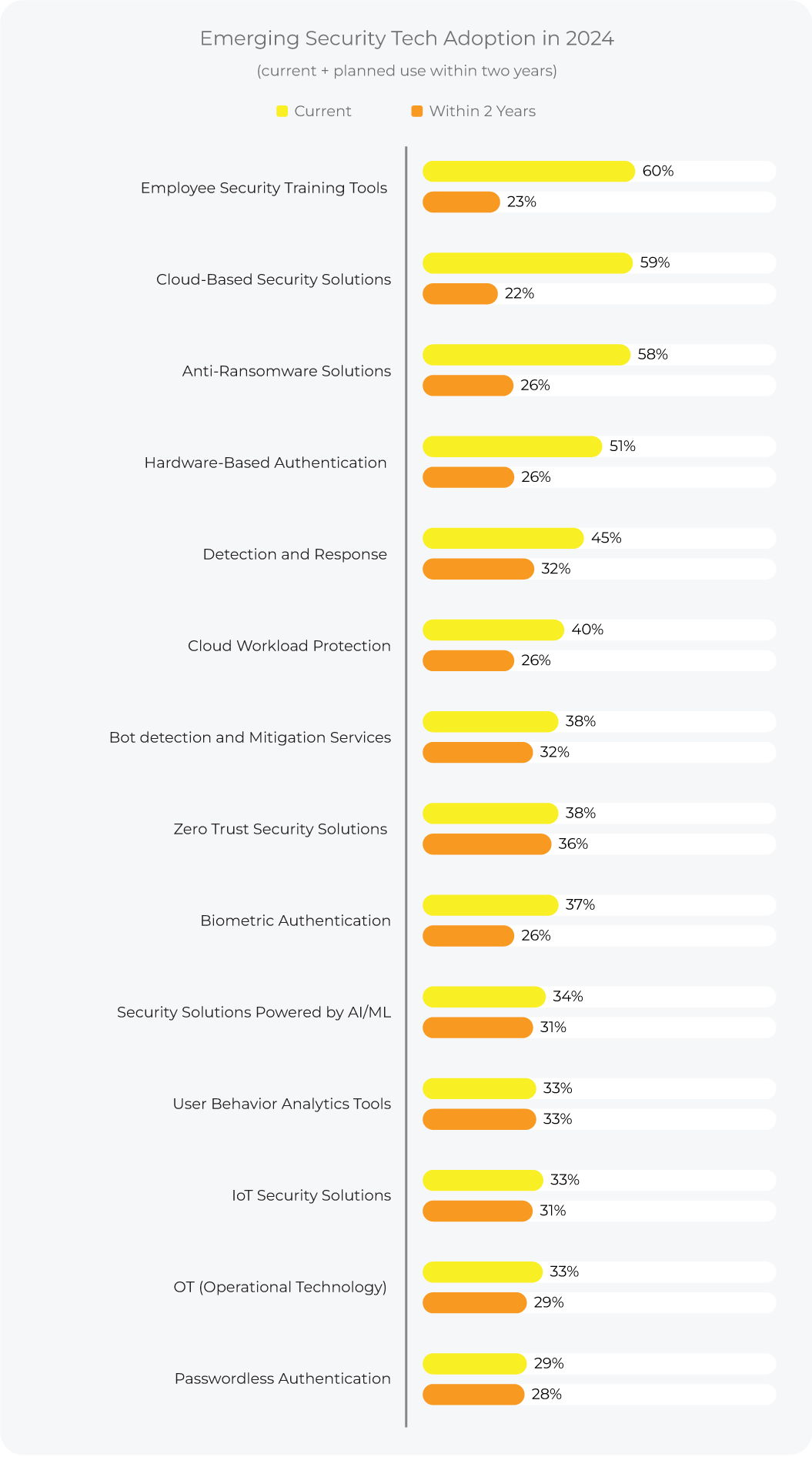

Given that increased security concerns are among the top reasons influencing IT spending growth, it shouldn’t come as a surprise that companies plan to adopt emerging cybersecurity technologies at a healthy pace in 2024.

Notably, nearly twice as many respondents anticipate adoption of the following within the next two years: User behavior analytics tools, passwordless authentication, IoT security solutions, zero trust security solutions, and security solutions powered by AI.

“Projected growth in selected cybersecurity solution categories reflects the current state of a rapidly-changing business context and technology landscape. Some of these are aimed at reducing security-related risks (e.g., anti-ransomware, security awareness training, detection and response, bot detection and mitigation). Others reflect the desire for lower cost (e.g., cloud-based security solutions, security solutions powered by AI/ML). Still others are about enablement of the organization’s workflows, business processes, and strategic initiatives (e.g., zero trust, user behavior analytics, IoT, OT, and new approaches to user authentication). Most organizations are looking for improvements in all three of those dimensions — and leading cybersecurity solution providers are responding to the needs of their buyers.”

Derek E. Brink, CISSP – Vice President and Research Fellow Aberdeen Strategy & Research, a division of SWZD

Derek E. Brink, CISSP – Vice President and Research Fellow Aberdeen Strategy & Research, a division of SWZD

Identifying the top IT teams (new in 2024)

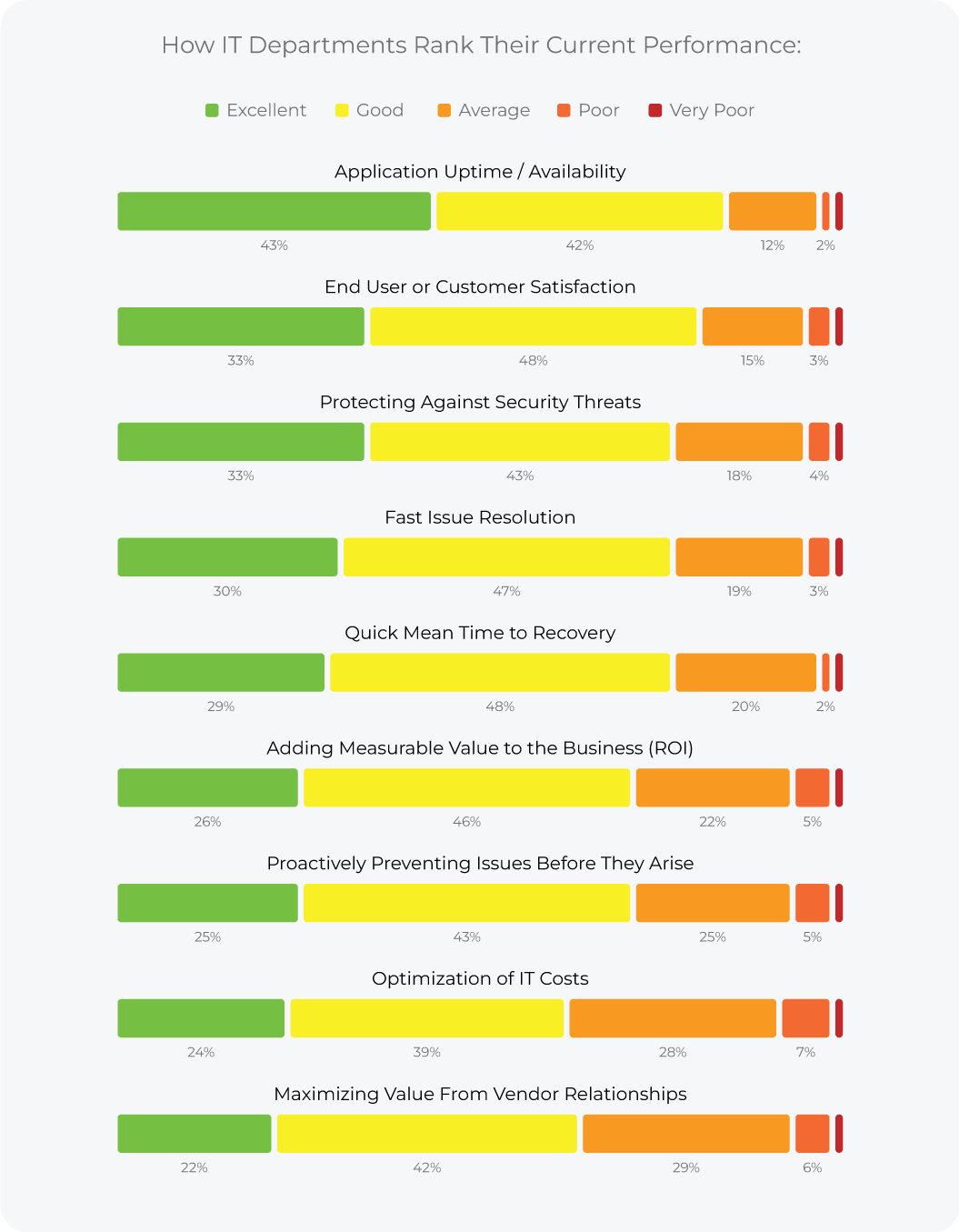

In this edition of our State of IT study, we set out to identify areas where IT teams are currently doing well and where they could use improvement. Now that the results are in, we know most IT departments believe they’re doing at least a “good” job across the IT metrics we’re tracking, with more than a third of respondents giving themselves “excellent” marks for application uptime, customer satisfaction, and protecting against security threats.

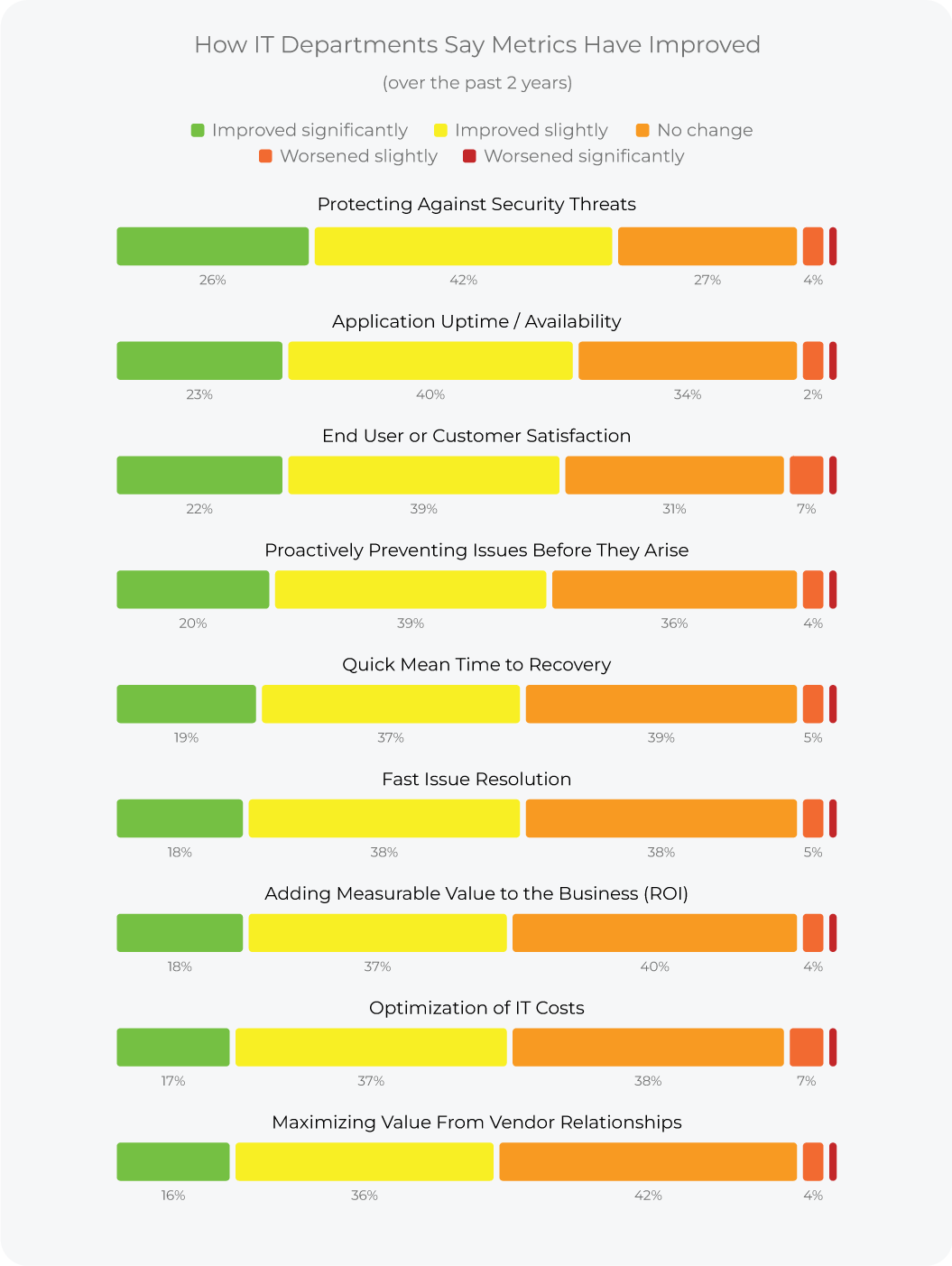

When we dug deeper into the data, we found a more telling way to measure IT teams’ relative performance is by tracking improvements across these same metrics over the last two years. Most companies believe they’ve improved at least slightly across all metrics, but relatively few say they’ve “improved significantly” in any area.

The biggest self-reported improvements in IT performance have come in protecting against security threats — perhaps thanks to budget increases being influenced by increased security concerns, in addition to plans to adopt emerging security technologies. Even so, it’s worth noting that the ultimate measure of success is not the grades we give ourselves, but whether the defenders actually reduced the number of successes by the attackers (i.e., successful data breaches, ransomware attacks, service disruptions, and so on).

The IT metrics where companies tend to rate themselves the lowest (in both current performance and improvement) are related to getting the most for their money: Optimization of IT costs, getting value out of their vendor relationships, and adding measurable value to the business (ROI). These three were also the least commonly tracked IT metrics.

Attributes of the top performing IT teams

Using the Aberdeen Strategy & Research “Best-in-Class” methodology based on these metrics, we created a proprietary model to rank IT teams based on their reported performance. We then analyzed the behaviors of Best-in-Class companies (those scoring in the top 20%) to see what sets them apart.

While these IT teams operate in companies of all sizes and across multiple regions and industries, they share certain common attributes. Best-in-Class companies are more likely to:

- Plan to raise IT budgets in 2024, by a greater amount on average

- Currently use and plan to adopt emerging technologies

- Work in companies that expect to see increased YoY revenues

- Track consumption of internal IT resources using a chargeback system

- Actively take steps to operate more efficiently / save money

Coming soon: An in-depth analysis of the characteristics of Best-in-Class IT teams, with advice on how to learn from their example.

Putting the State of IT into context

Going into 2024, the business world is navigating much uncertainty. The macroeconomic climate is unclear, and many companies are still dealing with pandemic-related challenges including rising product costs, fear of an economic recession, and an IT skills shortage.

While most companies are cutting back on some spending (both IT and non-IT), there’s encouraging news for IT departments and tech vendors alike. Two-thirds of companies plan to increase technology investments in 2024 and we expect overall IT spending to grow 6% YoY. At a company level, the average IT budget is expected to grow by a median of 5%.

These forward-looking stats are useful benchmarks whether you’re an IT professional working to get approval for your IT budget requests, or if you’re a tech vendor making future marketing plans.

Importantly, over the past several years, our research has shown investments in technology have yielded positive results across companies of all sizes. It’s crucial to note that the top performing IT teams are significantly more likely to increase their budgets and invest in emerging technologies that give them a competitive edge.

Dive Deeper into the State of IT

You’ve just read many of the key insights from the 2024 State of IT, but we’re just scratching the surface. In our quest to help everyone in IT do their jobs better, we’ve compiled even more insights that can help you in your role, whether you want more detailed budget breakdowns or more commentary on how our findings affect you.

Check out additional analysis from the 2024 State of IT

Methodology: In late June and July 2023, Spiceworks and Aberdeen Strategy & Research surveyed 883 IT professionals representing companies in North America and Europe to surface insights that help everyone in IT do their jobs better.

Log In

Log In

Log In

Log In